Year-End Giving: What to Know About Tax-Deductible Donations

As the year comes to a close, many people start thinking about generosity, reflection, and how they want to make a difference. For some, that also includes questions about tax-deductible donations and how charitable giving fits into year-end planning.

This guide is here to make things simple. Whether you are giving for the first time or have supported Art in Action before, here is what to know as you consider a year-end gift.

We encourage you to consult a tax professional for advice specific to your situation.

Are Donations to Art in Action Tax Deductible?

Yes. Art in Action is a registered 501(c)(3) nonprofit organization, and donations are tax deductible to the extent allowed by law. After you make a gift, you will receive a confirmation that you can keep for your records.

This includes gifts made through year-end donations, donations made through our e-card program, or anytime you want to give.

What Counts as a Tax-Deductible Donation?

In general, donations may be tax deductible when:

You make a monetary or in-kind gift to a qualified nonprofit organization

The donation is made by December 31 of the current tax year

You do not receive goods or services of equal value in return

When you send an Art in Action e-card and make a donation in honor of someone, the donation portion is tax deductible. The e-card itself is considered a thank-you, not a product of equal value.

Important Year-End Giving Deadlines

To count toward this tax year:

Online donations must be completed by December 31

Donations made by credit card are deductible for the year they are charged

Checks must be postmarked by December 31

Planning ahead helps ensure your gift is counted correctly and gives you peace of mind during a busy season.

Different Ways to Give Before Year End

There are many ways to support art education while making a tax-deductible gift.

Making an online donation is a quick and secure way to support Art in Action. Online gifts can be made at any time and provide an immediate confirmation for your records.

Our e-cards are a meaningful way to celebrate, say thank you, or honor someone special while making a donation. Designs include a mix of student artwork and Art in Action designs. When you send an e-card, the donation supports hands-on art education in classrooms that need it most.

You may also donate by check. Checks must be postmarked by December 31 to count toward the current tax year. Please make checks payable to Art in Action.

Cash gifts are accepted and are tax deductible when properly receipted. Please be sure to request a receipt for your records.

If you give through a donor-advised fund, you can recommend a grant to Art in Action as part of your year-end giving. Our team is happy to provide any information your fund administrator may need.

Many employers offer matching gift programs. A quick request could double your impact and help us reach even more students.

Why People Choose to Give at Year End

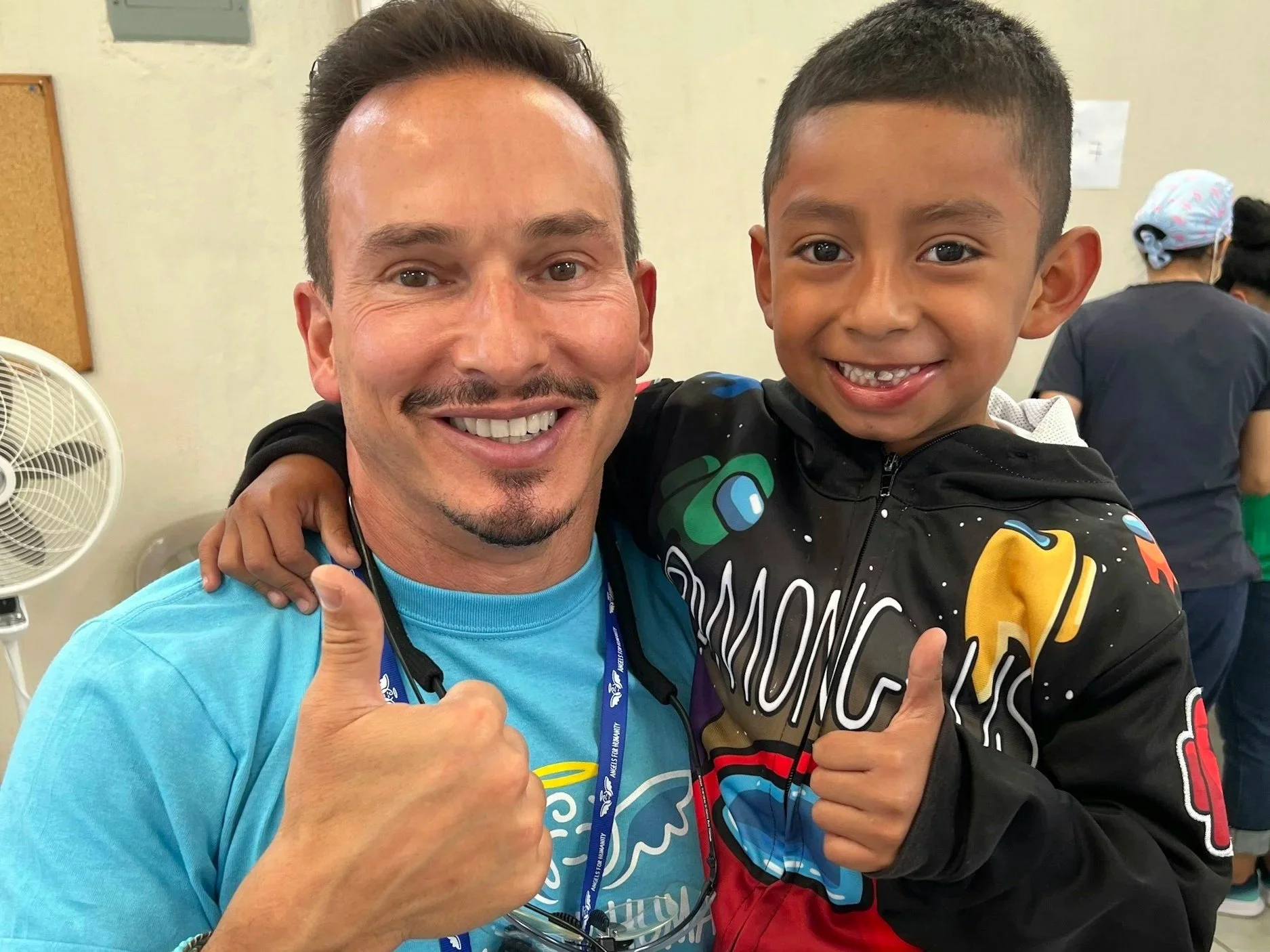

To take a tax benefit is a bonus, but what truly is motivating to donors is the difference a gift makes in the life of students.

One student shared their thoughts after an Art in Action lesson:

“Art makes me feel calm and proud of myself. When I’m drawing, I feel like I can do anything.”

Moments like this are why people choose to give. To be able to participate in an art lesson allows students to slow down, express themselves, and build confidence. It creates a sense of belonging and possibility, especially for children who may not have many opportunities to create..

Your year-end gift helps make these moments possible in classrooms.

Thank You for Supporting Art Education

We are grateful for every gift, at any time of year. If you are considering a year-end donation, thank you for being our partner in bringing art education into the lives of children.

If you have questions about giving options or need additional information, our team is always happy to help.

We encourage you to consult a tax professional for advice specific to your situation.